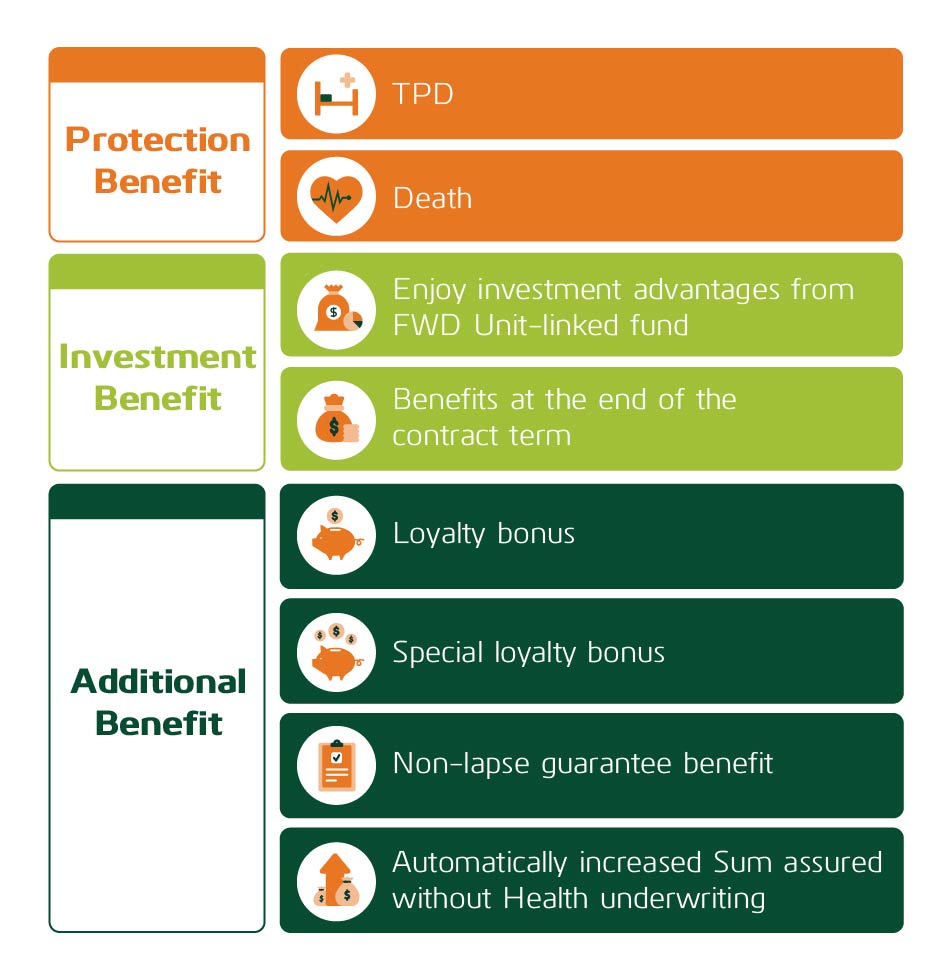

I. PROTECTION BENEFITS

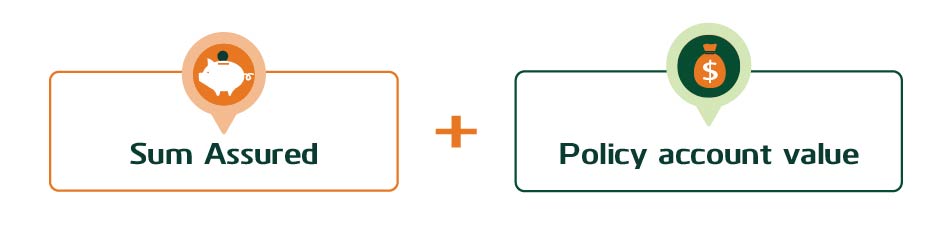

1. In case of Total and Permanent Disability (TPD) or Death

FWD Elevating success equips your family with financial support that helps your family maintain quality of life during difficult times.

Payment level(1):

(1) Details of how to determine the Sum Assured (SA) and the Policy Account Value upon death or TPD of Life assured are specified in the Terms and Conditions.

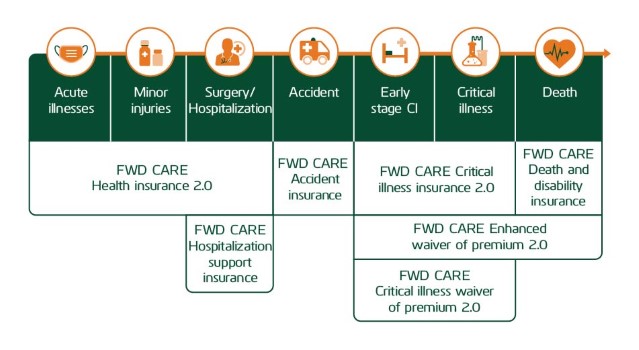

2. In case of critical illnesses, accidents, hospitalization, etc.

As protection needs of each customer are not the same, FWD has designed a wide range of riders that gives you the flexibility to choose based on your needs.

By paying a reasonable premium, you can increase your protection benefits for yourself and your family.

II. INVESTMENT BENEFITS

1. Enjoy investment advantages from FWD Unit linked fund

a. Funds are selected to be streamlined, easy to understand, while still allowing customers to design flexibly according to their demand

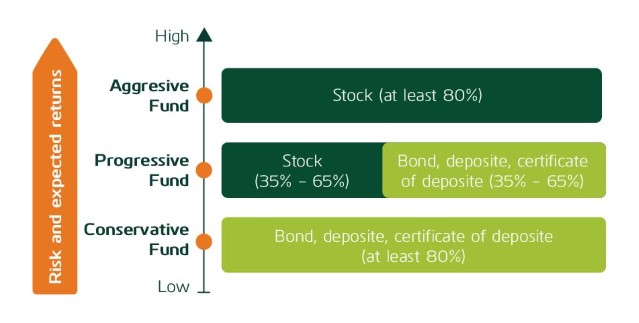

3 FWD investment funds are set up from conservative to risky investment policies, giving you the flexibility to tailormade your own investment portfolio. Depending on the expected return and risk tolerance, you can choose to invest in 1 or more than 1 funds.

In particular, the portfolio of equity is selected specifically by industry, making it easy for investors to update market changes.

Stock portfolio is optimally combined from industries with high growth potential and industry with stable growth potential to create a balanced portfolio that meets the expectation of maximizing returns in the medium and long-term, those are:

- Real estate

- Finance

- Consumer goods

b. Easy investment with professional investors

* FWD Unit linked funds are managed by SSI Assets Management (SSIAM).

The advantages of investing through professional investment funds:

- Access to many forms and investment opportunities

- Diversify your portfolio without the need for large capital

- Invested by a team of experienced experts

- Manage professionally with activities are constantly updated

c. Investment plan is flexibly adjusted at any time online

A good investment plan needs to be flexible with market changes, with FWD Unit linked funds, you can adjust your investment plan at its sole discretion:

- Change in the allocation rate of insurance premiums to funds (change in investment allocation rate) when you might change your investment objectives & risk tolerance

- Convert funds to take advantage of investment opportunities reacting to market conditions

- Invest more when your financial capacity changes

- Withdraw money from the Fund Value of the contract

2. Benefits at the end of the contract term

At the Maturity Date, FWD will pay the entire Policy account value determined according to:

- Number of Fund units at the Contract Term End Date; and

- Fund unit price at the Valuation Date right after the Contract Term End Date.

3. FWD Unit linked funds

a. FWD unit linked funds

Unit linked funds are established by FWD with investment policy from conservative to risky.

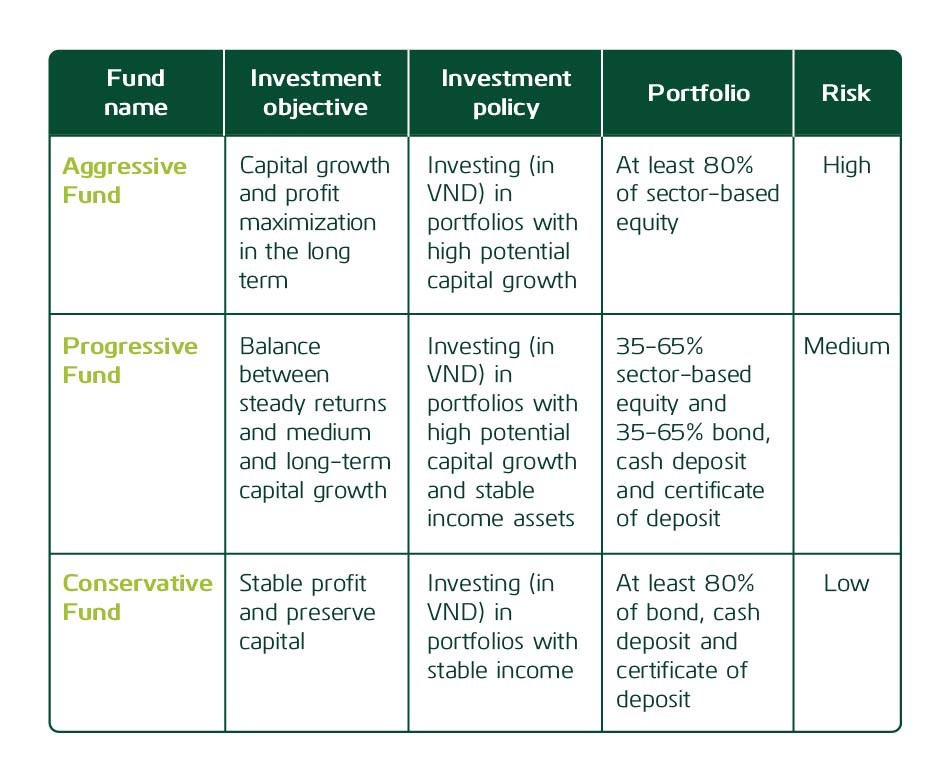

Details of investment objectives and policies of each fund are as follows:

FWD's 3 Unit linked funds are set up with a conservative to aggressive range of investment choices as options for you to choose from. Depending on the expected return and risk appetite, you can choose to invest in 1 or more than 1 funds.

b. Validation date

Valuation date is the date FWD determines the fund unit price for each fund type. The fund unit price is announced every Tuesday and Thursday (except for holidays and Tet).

III. ADDITIONAL BENEFITS

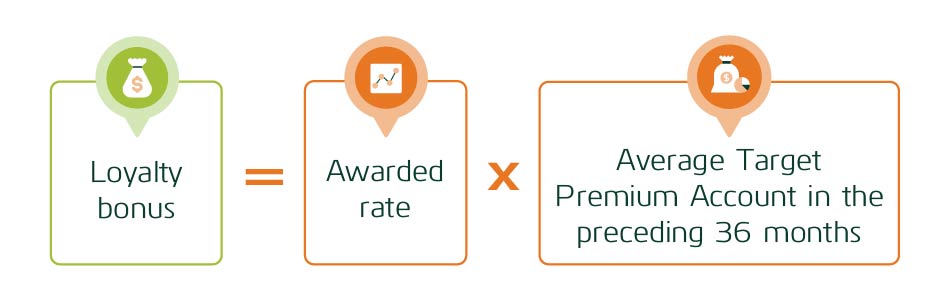

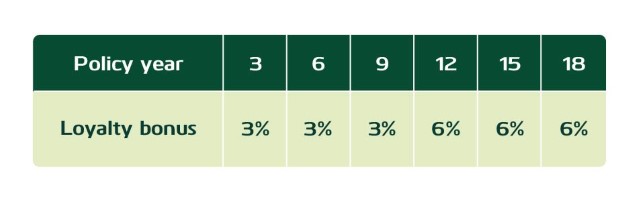

1. Loyalty Bonus

Every 3 years from Year 3 to Year 18, you will receive:

Bonus rates (%) are listed as below:

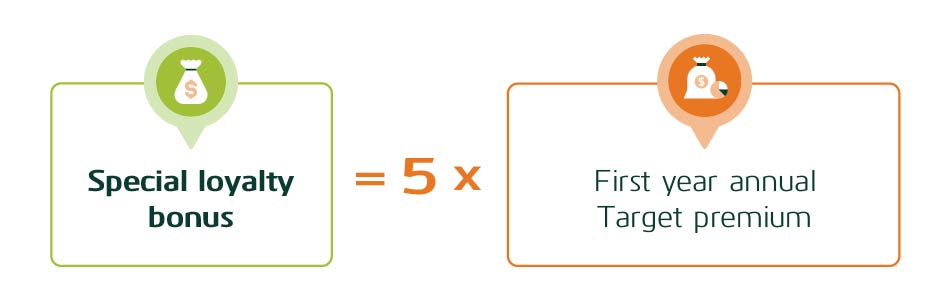

2. Special Loyalty Bonus (2)

On the Valuation date right after the end of Year 20, you will receive:

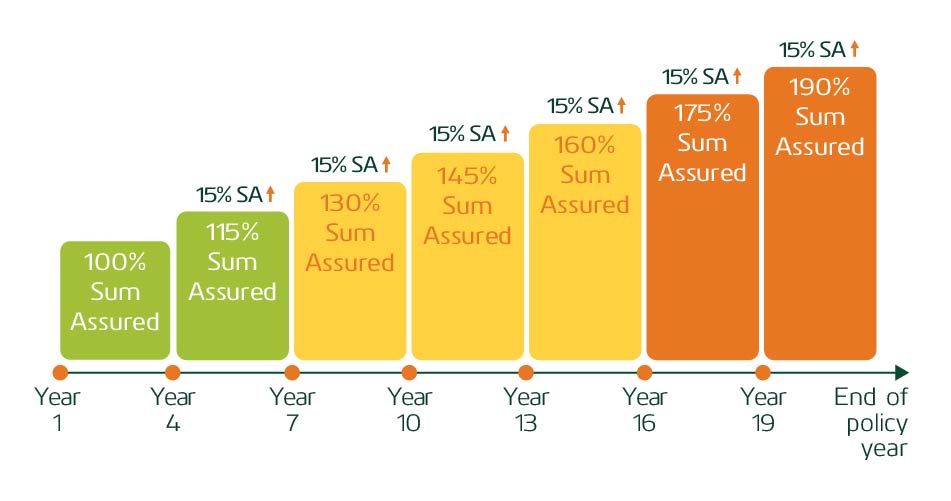

3. Automatically increased Sum assured without Health underwriting

FWD understands your protection needs will increase as you get older. Despite of health condition difference, FWD Elevating success is still guaranteed to increase your sum assured every 3 years without health underwriting and premium increasing:

The additional SA is equal to 15% of the Sum assured of the 1st Policy year. Increasing SA under this benefit does not change Basic Premium.

After the new SA becomes effective, the Cost of insurance and the main product benefits will change accordingly with the New SA.

4. Non-lapse guarantee benefit

During the first 3 policy years, if the basic premium is paid in full, on time and has never been withdrawn from the Insurance Account, your policy is still guaranteed to remain effective even when Insurance account is not enough to cover the Risk premium and Management Fee.