Please refer to Terms & Conditions of product for more details.

I. PROTECTION BENEFIT

1. Late-stage Cancer

Late-stage cancer cover up to 80 years old, providing a practical protection for customers who are at the age of higher risk of Critical illness.

After late-stage Cancer benefit is paid, the policy continues to be in-force.

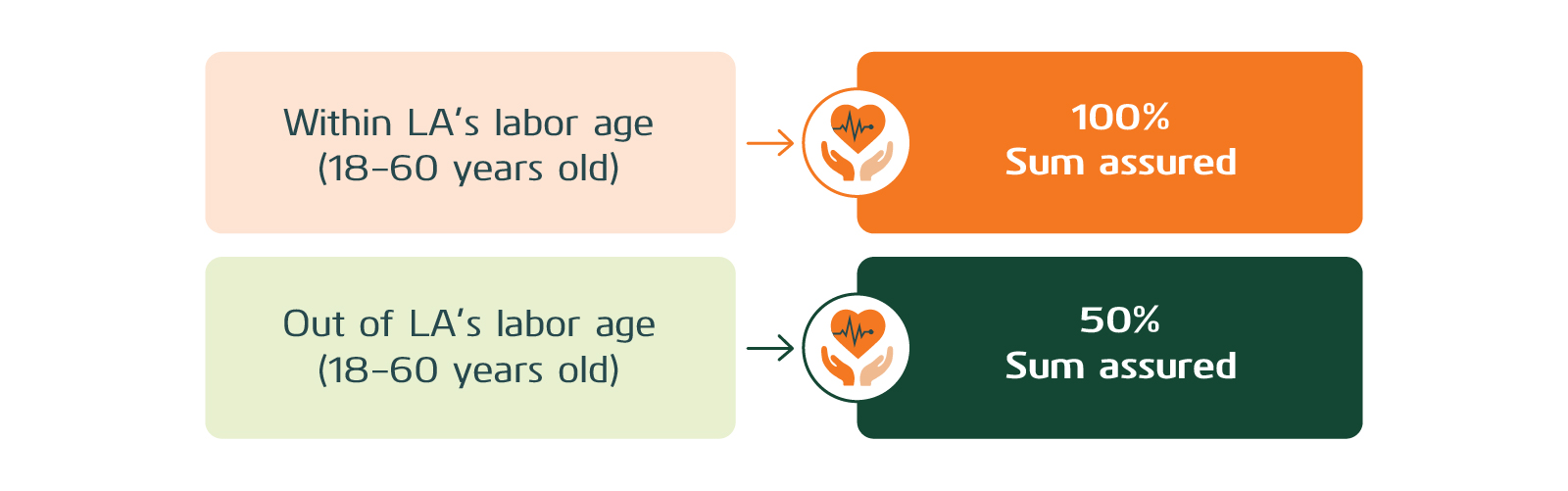

2. Total and Permanent disability (TPD) or Death

The policy will be terminated upon payout of TPD benefit or Death benefit.

3. Total and Permanent disability income support

To increase the meaningful survival, the plan has built-in Total and Permanent disability benefit depending on the age of Life assured, and if this happens, we will pay:

II. INVESTMENT BENEFIT

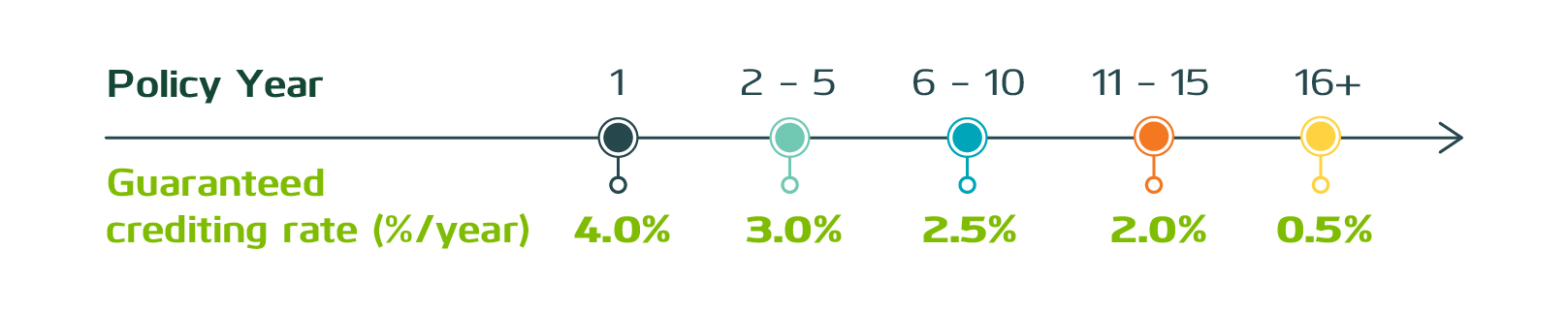

1. Crediting interest rate earned from FWD Universal Life Fund

Since the inception, the Policy account will earn interest according to actual performance of our Universal Life Fund and this will not be lower than our guaranteed interest rates as below:

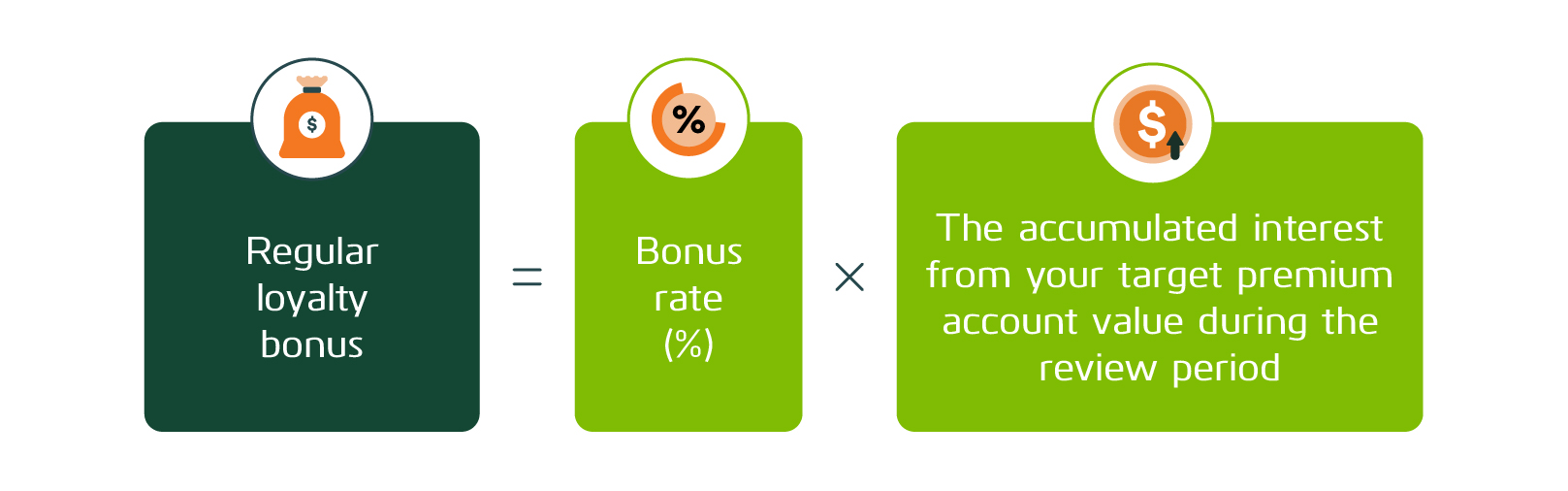

2. Loyalty bonus

* Regular loyalty bonus

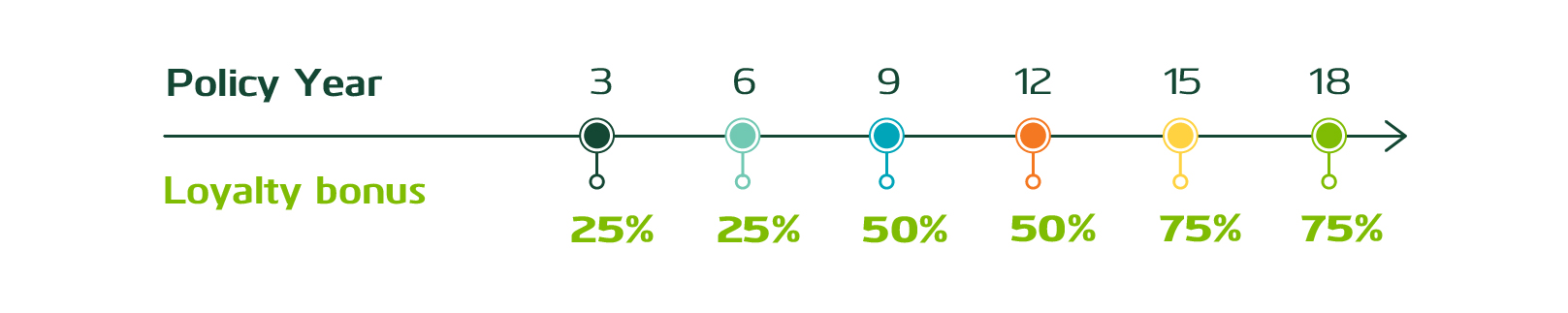

Every 3 years, from Year 1 to Year 18, we will give you a regular loyalty bonus as below:

Bonus rates are listed as below:

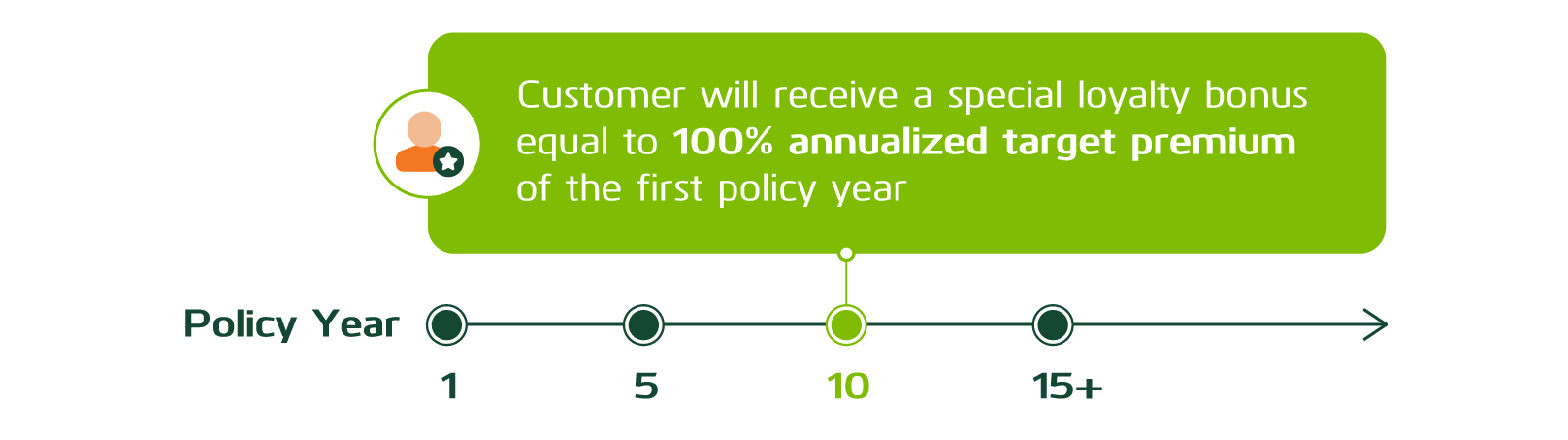

* Special loyalty bonus:

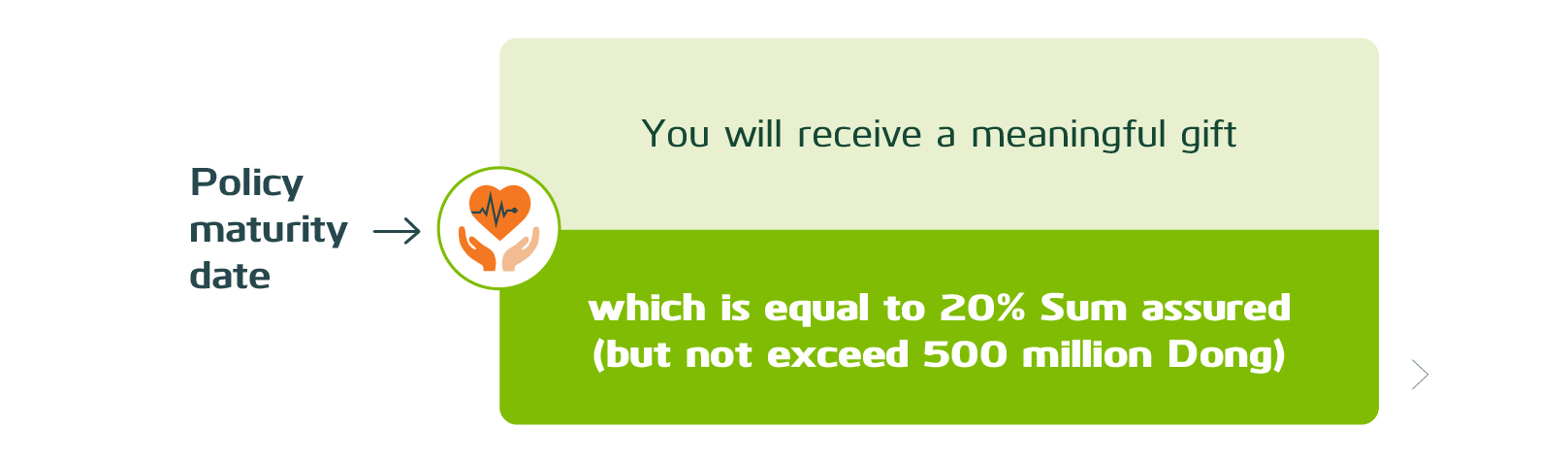

3. Policy maturity benefit

You will receive your full account value at the Policy maturity date.

III. ADDITIONAL BENEFIT

1. Well-being benefit

2. Non-lapse guarantee

During the first 3 years, Target premium must be paid fully every year within the Policy year, and no withdrawal made from the Target premium account, your Policy will be guaranteed to maintain in-force even in case of Target premium account is insufficient to cover monthly Cost of insurance and Admin charge.

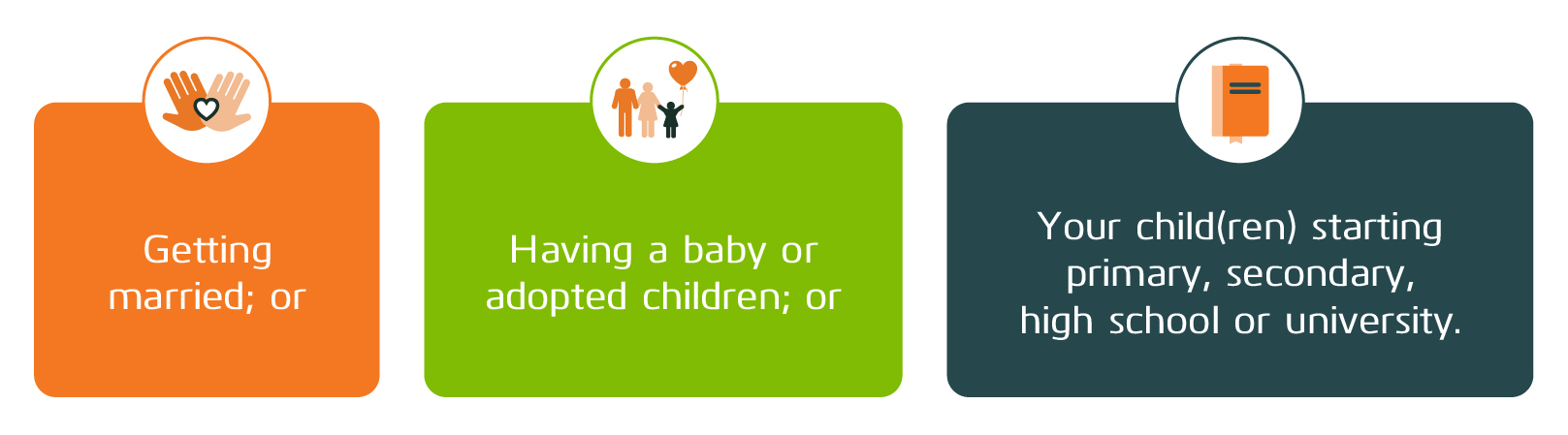

3. Automatically increased sum assured without health underwriting

You can request to increase the Sum assured at the following key milestones without going through underwriting:

4. Group participation bonus

Customers participating in group, will receive bonus amount up to 20% of your annual premiums in Year 1.

IV. FLEXIBLE FEATURES

1. Flexible sum assured options

With the same premium, you have the flexibility to select Sum assured depending on your preference/ priority need at inception, either focusing on protection, or investment, or balancing both. In addition, you also have the flexibility to adjust chosen plan in the future once your need changes.

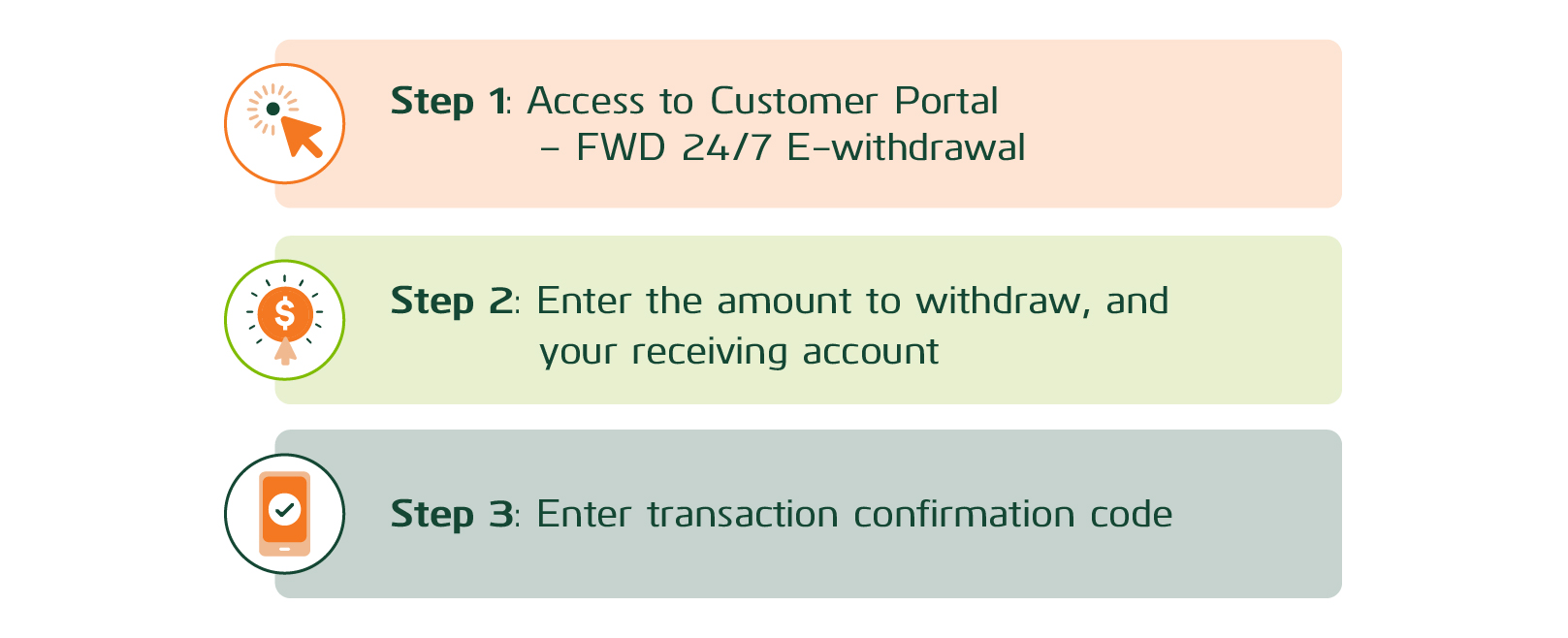

2. 24/7 e-withdrawal

This gives you flexibility and control over all financial needs. With just a few simple steps on your phone, without any charges, you can withdraw money from your insurance policy anytime, anywhere: