BOARD OF DIRECTORS - THE BOARD OF MANAGEMENT

Pioneer in creating the Foundation

FINANCIAL STATEMENTS

| Financial statements | 2022 | 2023 | |

|---|---|---|---|

| A | Financial statements | ||

| 1 | Total assets | 1,813,815 | 1,839,613 |

| 2 | Revenue | 114,592 | 135,614 |

| 3 | Tax paid in the period | 6,426 | 11,648 |

| 4 | Profit before tax | 37,368 | 41,244 |

5 | Profit after tax | 29,919 | 33,054 |

| B | Key financial indicators | ||

1 | Capital | ||

| 1.1 | Charter capital | 47,325 | 55,891 |

| 1.2 | Capital adequacy ratio | 9.95% | 11.39% |

| 2 | Business results | ||

| 2.1 | Deposits | 31,181,399 | 32,949,742 |

| 2.2 | Loans | 2,351,845 | 2,724,301 |

| 2.3 | Debt collection | 2,166,889 | 2,600,818 |

| 2.4 | Non-performing loans | 7,820 | 12,634 |

| 2.5 | Loans (including corporate bonds)/Total deposits in 1st market (in VND) | 91.12% | 90.46% |

| 2.6 | Loan to deposit ratio (LDR) in compliance with regulations of State Bank of Vietnam(*) | 73.90% | 77.90% |

| 2.7 | Non-performing loans/Total outstanding loans in 1st market | 0.68% | 0.99% |

| 3 | Liquidity(*) | ||

| 3.1 | Liquidity reserve ratio | 25.00% | 19.60% |

| 3.2 | Liquidity ratio within 30 days | ||

VND | 73.10% | 105.40% | |

Foreign currencies in USD equivalent | 96.30% | 82.10% | |

%

%

%

%

%

%

| Total shares | Type of shares | Number of transferable shares | Number of restricted shares |

|---|---|---|---|

| 5,589,091,262 | Ordinary shares | 569,843,260 | 5,019,248,002 |

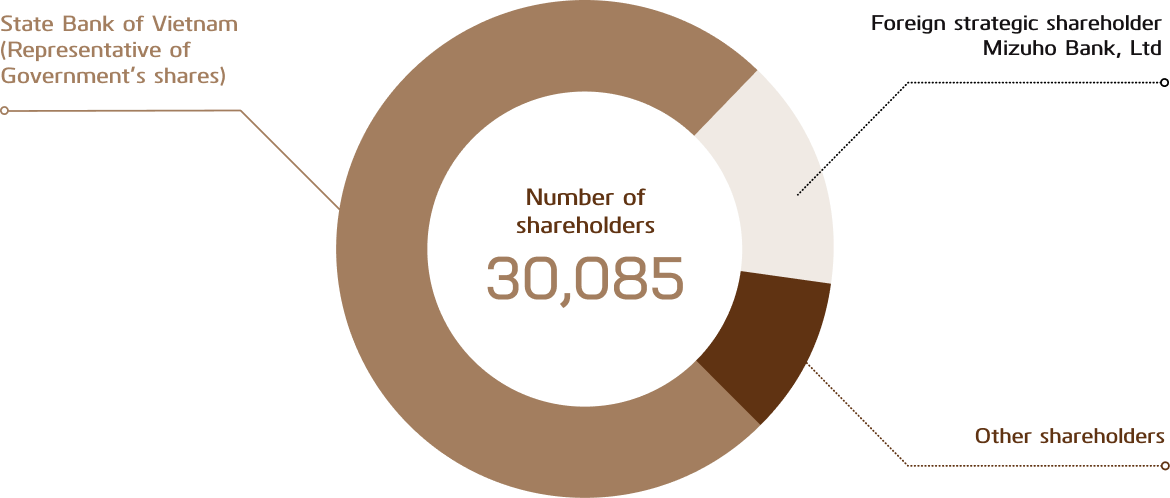

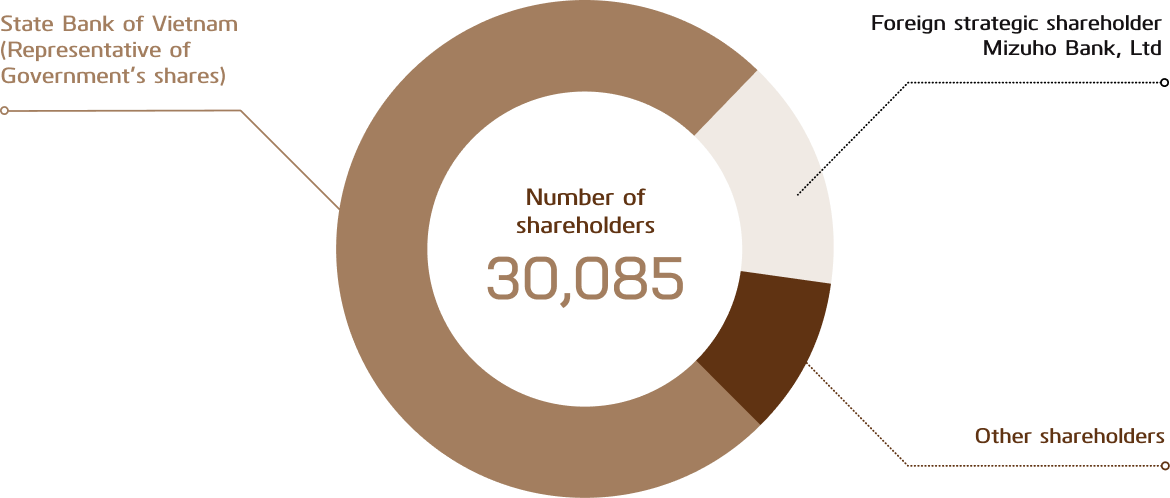

| No. | Name of shareholder | Total shares | Ownership rate | Number of shareholders |

|---|---|---|---|---|

| I | State Bank of Vietnam (Representative of Government’s shares) | 4,180,828,481 | 74.80% | 1 |

| II | Foreign strategic shareholder Mizuho Bank, Ltd | 838,372,264 | 15.00% | 1 |

| III | Other shareholders | 569,890,517 | 10.20% | 30,085 |

| 1 | Domestic individual shareholders | 40,094,837 | 0.71% | 28,308 |

| 2 | Domestic institutional shareholders | 62,808,938 | 1.12% | 166 |

| 3 | Foreign individual shareholders | 3,229,704 | 0.07% | 1,392 |

| 4 | Foreign institutional shareholders | 463,757,038 | 8.30% | 219 |

| Total | 5,589,091,262 | 100.00% | 30,087 |

Billion

Billion

(1963 - 2023)

(1963 - 2023)

- Organized product and service development Organized product and service development forums abroad in the Government’s investment promotion programs, work with senior leaders of multinational corporations to seek cooperation opportunities in providing financial services and funding for large sized projects.

- Completed the Project on reviewing development strategies to 2025, with an orientation to 2030 as a guideline for implementing action programs to ensure step by step implementation of set goals.

- Consolidated senior personnel: members of the Board of Directors, CEO, Deputy CEOs, Chief Accountant.

- Put 05 new branches into operation with business performance within 06 months of operation.

- Newly established Legal and Compliance Division, Capital & Market Division. Recruited and appointed a number of personnel, including highly qualified foreign personnel, to key positions to serve digital transformation and improve management capacity.

- Successfully organized the 60th Anniversary of VCB’s establishment (1963 - 2023) and received the Labor Hero title awarded by the Party and State.

- Being the only enterprise among the 5 groups honored at 18th Vietnam Glory Program for outstanding achievements in the patriotic emulation movement in Fatherland construction and protection. Honored as a Typical Enterprise for Employees for the fourth consecutive time and voted as the Bank with the best working environment in Vietnam for the eight consecutive year.

- VCB was honored as a typical tax payer for 3 consecutive years in 2020 - 2022 period and honored as one of the 20 enterprises with the best sustainable development index in the stock market.

- Actively promoted social security activities in 2023 with a total funding commitment of up to VND 506 billion and actual implementation of VND 309 billion.

TO SUCCESSFULLY DEPLOY APPLE PAY

TO SUCCESSFULLY DEPLOY APPLE PAY

- Firmly directed to promote credit growth right from the beginning of 2023 while maintaining strict credit standards. The focus remained on managing credit expansion towards expanding industries and clients with strong financial capabilities and risk resilience.

- VCB took proactive and responsible measures to adjust and lower lending interest rates to support businesses in their production and business recovery. Right from the beginning of the year, VCB implemented a 0.5% annual interest rate reduction for all customers with existing VND-denominated debt throughout the year 2023. Additionally, VCB launched various programs to lower lending interest rates for disbursements made during the year, providing support to customers in their production and business recovery efforts.

- In the context of challenging credit growth, the capital sources were continuously adjusted to provide a basis for reducing lending interest rates and supporting customers.

- Completed Phase 2 of the RTOM project with 55 deliverable reports for three components: (i) new sales and customer service model at branches, (ii) customer segmentation policies, and (iii) new retail credit model.

- Implemented the RLOS system across the entire portfolio, covering 72 retail credit products.

- Being one of the first six banks and the only state-owned bank to successfully deploy Apple Pay in the Vietnamese market.

- Successfully launched the Vietcombank Visa Infinite card with outstanding privileges, offering customers unique experiences.

- Successfully deployed and operated the private placement corporate bond trading system, enhancing VCB’s image, brand, and benefits.

- Signed comprehensive cooperation agreements with corporations and conglomerates, providing holistic financial solutions and specialized services for wholesale banking and retail banking.

(1963 - 2023)

(1963 - 2023)

- Organized product and service development Organized product and service development forums abroad in the Government’s investment promotion programs, work with senior leaders of multinational corporations to seek cooperation opportunities in providing financial services and funding for large sized projects.

- Completed the Project on reviewing development strategies to 2025, with an orientation to 2030 as a guideline for implementing action programs to ensure step by step implementation of set goals.

- Consolidated senior personnel: members of the Board of Directors, CEO, Deputy CEOs, Chief Accountant.

- Put 05 new branches into operation with business performance within 06 months of operation.

- Newly established Legal and Compliance Division, Capital & Market Division. Recruited and appointed a number of personnel, including highly qualified foreign personnel, to key positions to serve digital transformation and improve management capacity.

- Successfully organized the 60th Anniversary of VCB’s establishment (1963 - 2023) and received the Labor Hero title awarded by the Party and State.

- Being the only enterprise among the 5 groups honored at 18th Vietnam Glory Program for outstanding achievements in the patriotic emulation movement in Fatherland construction and protection. Honored as a Typical Enterprise for Employees for the fourth consecutive time and voted as the Bank with the best working environment in Vietnam for the eight consecutive year.

- VCB was honored as a typical tax payer for 3 consecutive years in 2020 - 2022 period and honored as one of the 20 enterprises with the best sustainable development index in the stock market.

- Actively promoted social security activities in 2023 with a total funding commitment of up to VND 506 billion and actual implementation of VND 309 billion.

TO SUCCESSFULLY DEPLOY APPLE PAY

TO SUCCESSFULLY DEPLOY APPLE PAY

- Firmly directed to promote credit growth right from the beginning of 2023 while maintaining strict credit standards. The focus remained on managing credit expansion towards expanding industries and clients with strong financial capabilities and risk resilience.

- VCB took proactive and responsible measures to adjust and lower lending interest rates to support businesses in their production and business recovery. Right from the beginning of the year, VCB implemented a 0.5% annual interest rate reduction for all customers with existing VND-denominated debt throughout the year 2023. Additionally, VCB launched various programs to lower lending interest rates for disbursements made during the year, providing support to customers in their production and business recovery efforts.

- In the context of challenging credit growth, the capital sources were continuously adjusted to provide a basis for reducing lending interest rates and supporting customers.

- Completed Phase 2 of the RTOM project with 55 deliverable reports for three components: (i) new sales and customer service model at branches, (ii) customer segmentation policies, and (iii) new retail credit model.

- Implemented the RLOS system across the entire portfolio, covering 72 retail credit products.

- Being one of the first six banks and the only state-owned bank to successfully deploy Apple Pay in the Vietnamese market.

- Successfully launched the Vietcombank Visa Infinite card with outstanding privileges, offering customers unique experiences.

- Successfully deployed and operated the private placement corporate bond trading system, enhancing VCB’s image, brand, and benefits.

- Signed comprehensive cooperation agreements with corporations and conglomerates, providing holistic financial solutions and specialized services for wholesale banking and retail banking.

(1963 - 2023)

(1963 - 2023)

- Organized product and service development Organized product and service development forums abroad in the Government’s investment promotion programs, work with senior leaders of multinational corporations to seek cooperation opportunities in providing financial services and funding for large sized projects.

- Completed the Project on reviewing development strategies to 2025, with an orientation to 2030 as a guideline for implementing action programs to ensure step by step implementation of set goals.

- Consolidated senior personnel: members of the Board of Directors, CEO, Deputy CEOs, Chief Accountant.

- Put 05 new branches into operation with business performance within 06 months of operation.

- Newly established Legal and Compliance Division, Capital & Market Division. Recruited and appointed a number of personnel, including highly qualified foreign personnel, to key positions to serve digital transformation and improve management capacity.

- Successfully organized the 60th Anniversary of VCB’s establishment (1963 - 2023) and received the Labor Hero title awarded by the Party and State.

- Being the only enterprise among the 5 groups honored at 18th Vietnam Glory Program for outstanding achievements in the patriotic emulation movement in Fatherland construction and protection. Honored as a Typical Enterprise for Employees for the fourth consecutive time and voted as the Bank with the best working environment in Vietnam for the eight consecutive year.

- VCB was honored as a typical tax payer for 3 consecutive years in 2020 - 2022 period and honored as one of the 20 enterprises with the best sustainable development index in the stock market.

- Actively promoted social security activities in 2023 with a total funding commitment of up to VND 506 billion and actual implementation of VND 309 billion.

- Action guidelines: “Conversion, Efficiency, Sustainability”.

- Directing and operating point of view: “Responsibility - Aggression - Creativity”.

- Continuing to focus on implementing 6 breakthroughs and 3 focuses in business restructuring.

- Drastically deploy the Strategic orientation to 2030 and the digital Transformation action plan in accordance with approved schedule, ensuring quality. Develop an innovation strategy to perfect VCB’s strategy, strengthen the foundation for implementing the mission, vision, and strategic goals until 2030.

- Strengthen the organization and improve the quality of human resources, focusing on human resources being adaptive for digital transformation. Develop digital culture in Vietcombank and applying Agile working methods.

- Innovate the growth model in depth, associated with restructuring operations; promote the overall strengths of the entire Vietcombank system.

- Promote customer care and product development, especially products and services on digital channels.

- Complete mechanisms and policies, especially mechanisms and policies for investment in procurement, recruitment and motivation for officials.

- Deploy successfully the plan on receiving a mandatory transfer of a weak credit institution.

- Restructuring credit portfolio towards higher efficiency and sustainability, increasing the proportion and quality of collateral in total outstanding loans. Wholesale credit growth associated with customer and service development; Retail credit growth associated with gradual shifting in product structure to prioritize loans into manufacturing and business industries.

- Striving to increase the proportion of service revenue. Increase services through digital channels and improve service quality and customer experience.

- Increasing the efficiency of capital management; optimizing long-term capital investment portfolio, making appropriate divestments and new investments to ensure sustainability and efficiency, strongly consolidating VCB’s market making position.

The Board of Directors has 01 independent member who fully meets the criteria and conditions specified in the Charter of the Bank and the following standards and conditions:

Not being a person who is working for the Bank itself or its subsidiaries or has worked for the Bank or its subsidiaries for the previous 03 (three) consecutive years;

Not being the recipient of the regular salary and remuneration of the Bank in addition to the allowances that the members of the Board of Directors are entitled to as prescribed;

Not being a person, whose spouse, father, mother, child, brother, sister and husband is a major shareholder of the Bank, a manager or a member of the Supervisory Board of the Bank or a subsidiary of the Bank;

Not directly or indirectly owning or representing 1% or more of the Bank’s charter capital or voting share capital; not with a related person own 5% or more of the charter capital or voting share capital of the Bank;

Not being a manager or a member of the Supervisory Board of the Bank at any time in the preceding 05 years.

Annually at the General Meeting of Shareholders, independent members of the Board of Directors shall report on the performance of the Board of Directors.

In 2023, Vietnam Joint Stock Commercial Bank for Foreign Trade (VCB) continues to uphold the action principle of “Transformation, Efficiency, Sustainability” and adheres to the guiding directives of “Responsibility - Determination - Innovation”.

Despite the multitude of challenges and difficulties faced by the overall economy and the banking sector in 2023, VCB exhibits proactive, flexible, and growth-oriented leadership. With a steadfast focus on safe, effective, and sustainable growth, the bank achieves commendable outcomes in its business operations. By December 31, 2023, VCB successfully fulfills the comprehensive targets and objectives assigned by the General Meeting of Shareholders and the State Bank of Vietnam (SBV).

During 2023, global and domestic economic conditions are marred by political instability, surging inflation, and significant interest rate hikes. Nevertheless, through proactive, adaptable, and growth-oriented management, VCB excels in fulfilling all tasks and objectives, showcasing its resilience and unwavering commitment to success.

Billion

Billion

- Total assets reached ~ VND 1,84 quadrillion, up ~1.4% from 2022 levels.

- Funding base as a whole increased in lockstep with capital consumption. Funding from customer deposits reached ~ VND 1.4 quadrillion, up ~ 11.8% from 2022 levels. The average proportion of current deposits reached ~33%.

- Credit balance reached ~ VND 1.28 quadrillion, up ~ 10.8% compared to the end of 2022, controlling within the growth rate assigned by the State Bank. Retail credit accounted for ~52% of total credit balance.

- Credit quality was strictly controlled. Bad debt ratio stood at 0.99%, significantly lower than the assigned plan. The ratio of provision for bad debts on the balance sheet reached 227%, the highest among the group of large banks in Vietnam. Recovery of written-off loans totaled VND 2,090 billion.

- Tax paid to the State Budget totaled VND 11,648 billion in 2023, confirming the bank’s position as a major contributor to the state budget.

- Profit before tax reached VND 41,244 billion, up ~10% compared to 2022, setting a new record and further being the bank with the leading profit scale in the market. The cost-to-income (CIR) ratio was controlled at a low level compared to plan (< 35%).

- With the results achieved, VCB maintained its position as a leading commercial bank in terms of quality and operational performance, continued to lead the banking industry and was one of the largest contributors to the state budget. VCB firmly held the position as a listed enterprise with the largest market capitalization in the Vietnam stock market, and was listed in the top 100 listed banks with the largest market capitalization in the world. VCB was voted No. 1 in the banking industry for the 8th consecutive time, ranked in the top 10 best places to work and was honored as a typical enterprise for employees for the fourth consecutive time. In 2023, Ho Chi Minh City Stock Exchange (HOSE) honored VCB stock as one of the 20 stocks with the best sustainable development index in the stock market and included in the list of component stocks of the VNSI 20 index (Vietnam Sustainability Index) in 2023.

In 2023, the Board of Directors has directed the Executive Board to focus on leading and effectively implementing the governance and management activities, ensuring consistency with the action principles of “Transformation, Efficiency, and Sustainability” and the guiding philosophy of “Responsibility - Determination - Innovation”. The focus will be on implementing the following specific pillars and breakthroughs in business:

- Capital mobilization: Flexibly manage capital mobilization activities in line with capital utilization and market trends.

- Credit activities: Exercise cautious credit growth in accordance with the appropriate direction, ensuring safety and efficiency.

- Implement effective programs with competitive interest rates tied to the development and utilization of associated products and services. Pioneering the reduction of interest rates to support customers, with a reduction of 0.5% in 2023.

- Tight control over the quality of credit debt and debt structure, ensuring the control of non-performing loan ratio below 1.5%.

- Strengthen the progress of handling and recovering bad debts, offshore debts; Enhance monitoring, urging, and directing the handling and recovery of problematic debts at branches, especially units with significant offshore debts and high debt collection targets in 2023.

- Direct the implementation of three business pillars: Retail, Services, and Investments, to gradually achieve six strategic breakthroughs and three focal points for business restructuring.

- Enhance the implementation of digital transformation action programs and conversion action plans.

- Completed the assignment of Members responsible for the activities of the Board of Directors, restructured senior personnel, ensuring consistent leadership and guidance from the VCB leadership.

- Restructured the organizational model and expanded the operational network; Issued regulations on the organization and operation of Regulatory and Compliance Units, Capital & Market Units; Recruited and appointed high-level personnel, including foreign personnel, for key positions to serve digital transformation and enhance management capacity.

- Successfully organized major events such as the 60th anniversary celebration of VCB’s establishment (1963-2023) and the reception of the Hero of Labor title awarded by the Party and the State, along with a series of celebratory events; Successfully organized the Extraordinary General Meeting of Shareholders in January 2023, the 16th Annual General Meeting of Shareholders, and the Extraordinary General Meeting of Shareholders in November 2023.

- Based on the approval of the Government and the State Bank of Vietnam (SBV), VCB has completed the payment of dividends in the form of shares at a rate of 18.1% to increase its charter capital to 55,891 billion VND. Currently, VCB continues to implement capital increase plans to reinforce and enhance its financial capacity.

- VCB continued to focus on sustainable development, constantly improving management capacity, operations, and emphasizing social welfare, environmental protection, and disease prevention. In 2023, VCB remained committed to and implements social welfare programs with a total amount of approximately 506 billion VND.

In 2023, the global economy and the economy of Vietnam were overshadowed by “headwinds”: escalating political conflicts, high inflation, and frequent interest rate adjustments. However, with a sense of responsibility and transparency in governance, the Board of Directors and Executive Board provided strong, decisive, flexible, and consistent guidance to ensure Vietcombank’s successful achievement of the annual targets in 2023. This was accomplished through sustainable growth, adherence to current laws and regulations, and compliance with the bank’s operational policies. The Executive Board implemented Vietcombank’s business activities in accordance with the defined direction and strategic objectives, ensuring income for employees and responsible business operations towards the community and stakeholders.

In January 2023, the Board of Directors issued Resolution 01 on the business direction for the year 2023. Throughout the year, the Board of Directors monitored and directed the Executive Board in accordance with the defined direction and strategic objectives of VCB’s business operations. All solutions were actively and synchronously implemented, ensuring compliance with the prescribed timelines and goals set by the Annual General Meeting of Shareholders. Most of the targets were completed according to the plan, and the Executive Board complied with the provisions of the Law on Credit Institutions, VCB’s Charter, and the Resolutions of the Board of Directors in terms of management and direction.

On a monthly basis, the Board of Directors holds a plenary meeting to evaluate the business performance, analyze market developments, and make timely decisions and directives based on real-time assessments. During these plenary meetings, the CEO reports on all aspects of the bank’s operations, the implementation of resolutions from the Annual General Meeting of Shareholders, and the resolutions and decisions of the Board of Directors. The CEO also reports on specific topics as requested by the Board of Directors. The Board of Directors delegates tasks and assigns responsibilities to each member of the Board and the CEO for implementation and direction. Weekly meetings are maintained by the Board of Directors to promptly address and resolve issues, files, and tasks arising from business operations within the authority and functions of the Board of Directors.

The members of the Board of Directors and the Executive Board always prioritize the interests of shareholders, the state, and the bank as their top operational objectives. They effectively carry out their directing and governing responsibilities and fulfill the assigned duties and tasks.

- Action guidelines: “Conversion, Efficiency, Sustainability”.

- Directing and operating point of view: “Responsibility - Aggression - Creativity”.

- Continuing to focus on implementing 6 breakthroughs and 3 focuses in business restructuring.

- Drastically deploy the Strategic orientation to 2030 and the digital Transformation action plan in accordance with approved schedule, ensuring quality. Develop an innovation strategy to perfect VCB’s strategy, strengthen the foundation for implementing the mission, vision, and strategic goals until 2030.

- Strengthen the organization and improve the quality of human resources, focusing on human resources being adaptive for digital transformation. Develop digital culture in Vietcombank and applying Agile working methods.

- Innovate the growth model in depth, associated with restructuring operations; promote the overall strengths of the entire Vietcombank system.

- Promote customer care and product development, especially products and services on digital channels.

- Complete mechanisms and policies, especially mechanisms and policies for investment in procurement, recruitment and motivation for officials.

- Deploy successfully the plan on receiving a mandatory transfer of a weak credit institution.

- Restructuring credit portfolio towards higher efficiency and sustainability, increasing the proportion and quality of collateral in total outstanding loans. Wholesale credit growth associated with customer and service development; Retail credit growth associated with gradual shifting in product structure to prioritize loans into manufacturing and business industries.

- Striving to increase the proportion of service revenue. Increase services through digital channels and improve service quality and customer experience.

- Increasing the efficiency of capital management; optimizing long-term capital investment portfolio, making appropriate divestments and new investments to ensure sustainability and efficiency, strongly consolidating VCB’s market making position.

The Board of Directors has 01 independent member who fully meets the criteria and conditions specified in the Charter of the Bank and the following standards and conditions:

Not being a person who is working for the Bank itself or its subsidiaries or has worked for the Bank or its subsidiaries for the previous 03 (three) consecutive years;

Not being the recipient of the regular salary and remuneration of the Bank in addition to the allowances that the members of the Board of Directors are entitled to as prescribed;

Not being a person, whose spouse, father, mother, child, brother, sister and husband is a major shareholder of the Bank, a manager or a member of the Supervisory Board of the Bank or a subsidiary of the Bank;

Not directly or indirectly owning or representing 1% or more of the Bank’s charter capital or voting share capital; not with a related person own 5% or more of the charter capital or voting share capital of the Bank;

Not being a manager or a member of the Supervisory Board of the Bank at any time in the preceding 05 years.

Annually at the General Meeting of Shareholders, independent members of the Board of Directors shall report on the performance of the Board of Directors.

In 2023, Vietnam Joint Stock Commercial Bank for Foreign Trade (VCB) continues to uphold the action principle of “Transformation, Efficiency, Sustainability” and adheres to the guiding directives of “Responsibility - Determination - Innovation”.

Despite the multitude of challenges and difficulties faced by the overall economy and the banking sector in 2023, VCB exhibits proactive, flexible, and growth-oriented leadership. With a steadfast focus on safe, effective, and sustainable growth, the bank achieves commendable outcomes in its business operations. By December 31, 2023, VCB successfully fulfills the comprehensive targets and objectives assigned by the General Meeting of Shareholders and the State Bank of Vietnam (SBV).

During 2023, global and domestic economic conditions are marred by political instability, surging inflation, and significant interest rate hikes. Nevertheless, through proactive, adaptable, and growth-oriented management, VCB excels in fulfilling all tasks and objectives, showcasing its resilience and unwavering commitment to success.

Billion

Billion

- Total assets reached ~ VND 1,84 quadrillion, up ~1.4% from 2022 levels.

- Funding base as a whole increased in lockstep with capital consumption. Funding from customer deposits reached ~ VND 1.4 quadrillion, up ~ 11.8% from 2022 levels. The average proportion of current deposits reached ~33%.

- Credit balance reached ~ VND 1.28 quadrillion, up ~ 10.8% compared to the end of 2022, controlling within the growth rate assigned by the State Bank. Retail credit accounted for ~52% of total credit balance.

- Credit quality was strictly controlled. Bad debt ratio stood at 0.99%, significantly lower than the assigned plan. The ratio of provision for bad debts on the balance sheet reached 227%, the highest among the group of large banks in Vietnam. Recovery of written-off loans totaled VND 2,090 billion.

- Tax paid to the State Budget totaled VND 11,648 billion in 2023, confirming the bank’s position as a major contributor to the state budget.

- Profit before tax reached VND 41,244 billion, up ~10% compared to 2022, setting a new record and further being the bank with the leading profit scale in the market. The cost-to-income (CIR) ratio was controlled at a low level compared to plan (< 35%).

- With the results achieved, VCB maintained its position as a leading commercial bank in terms of quality and operational performance, continued to lead the banking industry and was one of the largest contributors to the state budget. VCB firmly held the position as a listed enterprise with the largest market capitalization in the Vietnam stock market, and was listed in the top 100 listed banks with the largest market capitalization in the world. VCB was voted No. 1 in the banking industry for the 8th consecutive time, ranked in the top 10 best places to work and was honored as a typical enterprise for employees for the fourth consecutive time. In 2023, Ho Chi Minh City Stock Exchange (HOSE) honored VCB stock as one of the 20 stocks with the best sustainable development index in the stock market and included in the list of component stocks of the VNSI 20 index (Vietnam Sustainability Index) in 2023.

In 2023, the Board of Directors has directed the Executive Board to focus on leading and effectively implementing the governance and management activities, ensuring consistency with the action principles of “Transformation, Efficiency, and Sustainability” and the guiding philosophy of “Responsibility - Determination - Innovation”. The focus will be on implementing the following specific pillars and breakthroughs in business:

- Capital mobilization: Flexibly manage capital mobilization activities in line with capital utilization and market trends.

- Credit activities: Exercise cautious credit growth in accordance with the appropriate direction, ensuring safety and efficiency.

- Implement effective programs with competitive interest rates tied to the development and utilization of associated products and services. Pioneering the reduction of interest rates to support customers, with a reduction of 0.5% in 2023.

- Tight control over the quality of credit debt and debt structure, ensuring the control of non-performing loan ratio below 1.5%.

- Strengthen the progress of handling and recovering bad debts, offshore debts; Enhance monitoring, urging, and directing the handling and recovery of problematic debts at branches, especially units with significant offshore debts and high debt collection targets in 2023.

- Direct the implementation of three business pillars: Retail, Services, and Investments, to gradually achieve six strategic breakthroughs and three focal points for business restructuring.

- Enhance the implementation of digital transformation action programs and conversion action plans.

- Completed the assignment of Members responsible for the activities of the Board of Directors, restructured senior personnel, ensuring consistent leadership and guidance from the VCB leadership.

- Restructured the organizational model and expanded the operational network; Issued regulations on the organization and operation of Regulatory and Compliance Units, Capital & Market Units; Recruited and appointed high-level personnel, including foreign personnel, for key positions to serve digital transformation and enhance management capacity.

- Successfully organized major events such as the 60th anniversary celebration of VCB’s establishment (1963-2023) and the reception of the Hero of Labor title awarded by the Party and the State, along with a series of celebratory events; Successfully organized the Extraordinary General Meeting of Shareholders in January 2023, the 16th Annual General Meeting of Shareholders, and the Extraordinary General Meeting of Shareholders in November 2023.

- Based on the approval of the Government and the State Bank of Vietnam (SBV), VCB has completed the payment of dividends in the form of shares at a rate of 18.1% to increase its charter capital to 55,891 billion VND. Currently, VCB continues to implement capital increase plans to reinforce and enhance its financial capacity.

- VCB continued to focus on sustainable development, constantly improving management capacity, operations, and emphasizing social welfare, environmental protection, and disease prevention. In 2023, VCB remained committed to and implements social welfare programs with a total amount of approximately 506 billion VND.

In 2023, the global economy and the economy of Vietnam were overshadowed by “headwinds”: escalating political conflicts, high inflation, and frequent interest rate adjustments. However, with a sense of responsibility and transparency in governance, the Board of Directors and Executive Board provided strong, decisive, flexible, and consistent guidance to ensure Vietcombank’s successful achievement of the annual targets in 2023. This was accomplished through sustainable growth, adherence to current laws and regulations, and compliance with the bank’s operational policies. The Executive Board implemented Vietcombank’s business activities in accordance with the defined direction and strategic objectives, ensuring income for employees and responsible business operations towards the community and stakeholders.

In January 2023, the Board of Directors issued Resolution 01 on the business direction for the year 2023. Throughout the year, the Board of Directors monitored and directed the Executive Board in accordance with the defined direction and strategic objectives of VCB’s business operations. All solutions were actively and synchronously implemented, ensuring compliance with the prescribed timelines and goals set by the Annual General Meeting of Shareholders. Most of the targets were completed according to the plan, and the Executive Board complied with the provisions of the Law on Credit Institutions, VCB’s Charter, and the Resolutions of the Board of Directors in terms of management and direction.

On a monthly basis, the Board of Directors holds a plenary meeting to evaluate the business performance, analyze market developments, and make timely decisions and directives based on real-time assessments. During these plenary meetings, the CEO reports on all aspects of the bank’s operations, the implementation of resolutions from the Annual General Meeting of Shareholders, and the resolutions and decisions of the Board of Directors. The CEO also reports on specific topics as requested by the Board of Directors. The Board of Directors delegates tasks and assigns responsibilities to each member of the Board and the CEO for implementation and direction. Weekly meetings are maintained by the Board of Directors to promptly address and resolve issues, files, and tasks arising from business operations within the authority and functions of the Board of Directors.

The members of the Board of Directors and the Executive Board always prioritize the interests of shareholders, the state, and the bank as their top operational objectives. They effectively carry out their directing and governing responsibilities and fulfill the assigned duties and tasks.

- Action guidelines: “Conversion, Efficiency, Sustainability”.

- Directing and operating point of view: “Responsibility - Aggression - Creativity”.

- Continuing to focus on implementing 6 breakthroughs and 3 focuses in business restructuring.

- Drastically deploy the Strategic orientation to 2030 and the digital Transformation action plan in accordance with approved schedule, ensuring quality. Develop an innovation strategy to perfect VCB’s strategy, strengthen the foundation for implementing the mission, vision, and strategic goals until 2030.

- Strengthen the organization and improve the quality of human resources, focusing on human resources being adaptive for digital transformation. Develop digital culture in Vietcombank and applying Agile working methods.

- Innovate the growth model in depth, associated with restructuring operations; promote the overall strengths of the entire Vietcombank system.

- Promote customer care and product development, especially products and services on digital channels.

- Complete mechanisms and policies, especially mechanisms and policies for investment in procurement, recruitment and motivation for officials.

- Deploy successfully the plan on receiving a mandatory transfer of a weak credit institution.

- Restructuring credit portfolio towards higher efficiency and sustainability, increasing the proportion and quality of collateral in total outstanding loans. Wholesale credit growth associated with customer and service development; Retail credit growth associated with gradual shifting in product structure to prioritize loans into manufacturing and business industries.

- Striving to increase the proportion of service revenue. Increase services through digital channels and improve service quality and customer experience.

- Increasing the efficiency of capital management; optimizing long-term capital investment portfolio, making appropriate divestments and new investments to ensure sustainability and efficiency, strongly consolidating VCB’s market making position.