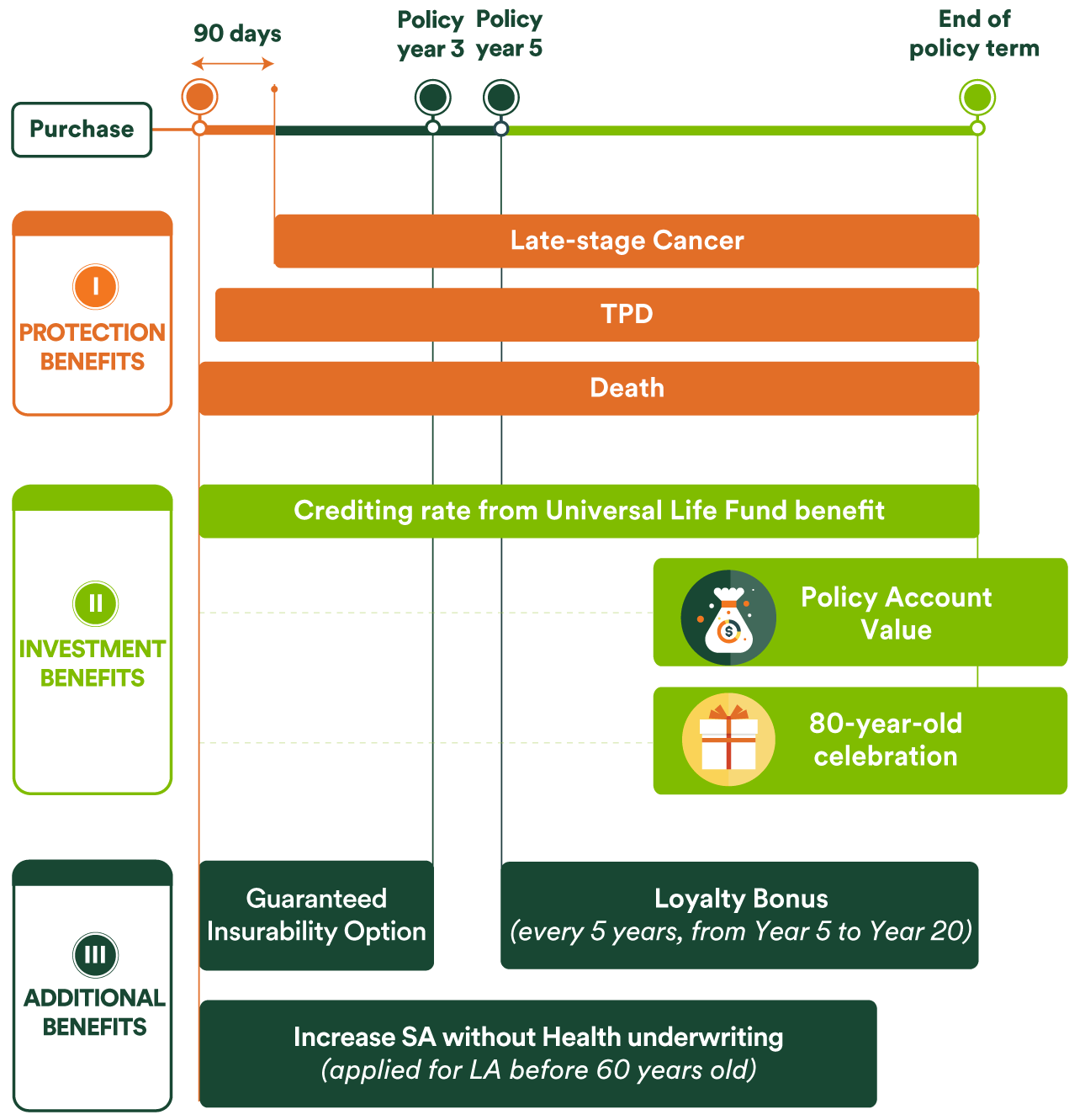

I. PROTECTION BENEFITS

1. Late-stage Cancer benefit:

After Late-stage cancer benefit is paid, the policy continues to be in-force, and customer will continue to receive the Total and Permanent Disability benefit (TPD) or Death benefit upon insurable events.

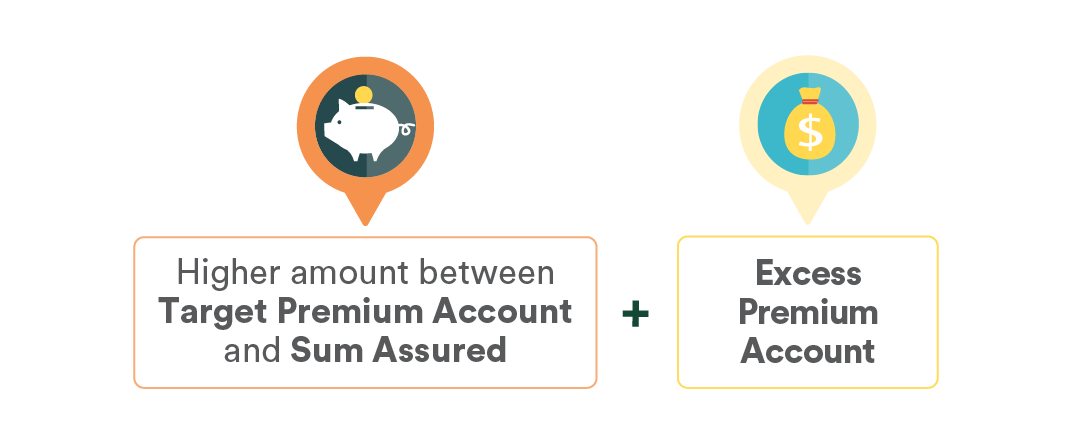

2. Total and Permanent disability benefit:

The policy will be terminated upon payout of TPD benefit.

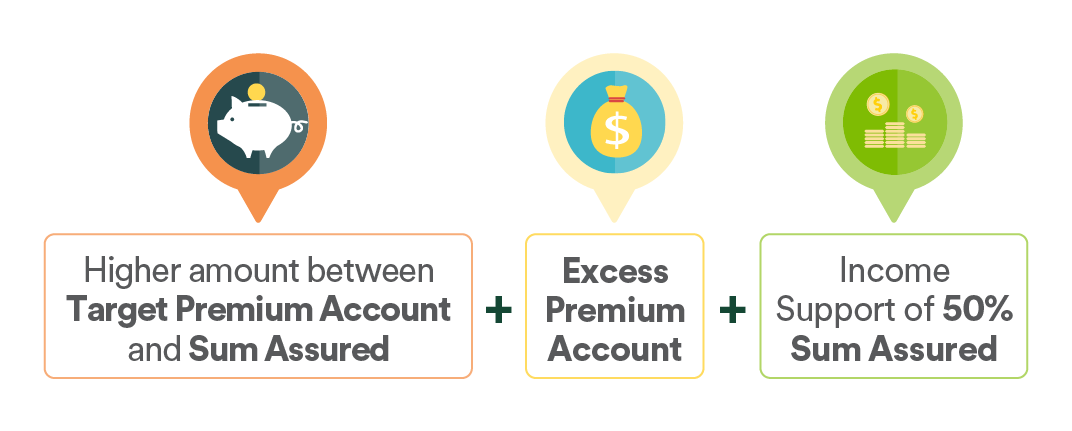

3. Death benefit:

The policy will be terminated upon death of Life Assured.

II. INVESTMENT BENEFITS

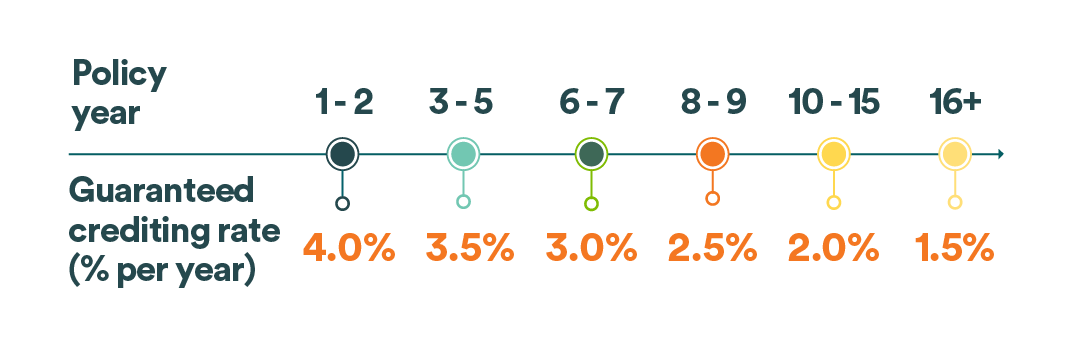

1. Crediting interest rate earned from Universal Life Fund:

Since inception, the Policy Account value will earn interest according to the declared interest rate based on actual investment result of Universal life fund.

In all cases, declared interest rate will not be lower than guaranteed interest rate as below:

2. Maturity benefit:

At Policy anniversary date after Life Assured attains age 80, customer will receive total Policy Account value.

3. 80-year-old celebration benefit:

At Policy anniversary date after Life Assured attains age 80, FWD will pay an additional amount of 20% Sum Assured as a meaningful gift to celebrate golden age.

III. Additional benefits

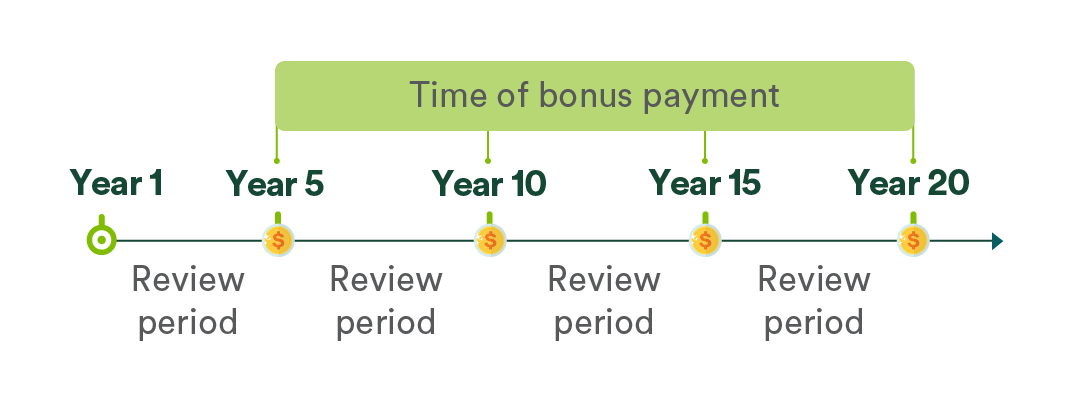

1. Loyalty Bonus:

Customer can enjoy loyalty bonus when paying full premiums.

Bonus: 50% of accumulated interest of Target Premium Account of the Policy declared by FWD during Review period.

2. Increase Sum Assured without Health Underwriting:

FWD offers customers a higher level of face value protection during life milestones, giving customers the health underwriting waiver benefit when they increase their Sum Assured in the following events:

- Life Assured’s marriage;

- Life Assured’s having a baby or adopting a child;

- Life Assured’s child starting primary school, secondary school, high school or university.

3. Non-lap guarantee

In the first 3 policy years, if the customer pay fully and in due Target premium; and no withdrawal has been made from Target Premium Account, the policy will be guaranteed to maintain in-force even in case of Target Premium Account is insufficient to cover monthly Cost of insurance and Admin charge.